Now Reading: The World Islands: 6 Unique Villas Built for Private Island Living in 2025

-

01

The World Islands: 6 Unique Villas Built for Private Island Living in 2025

The World Islands: 6 Unique Villas Built for Private Island Living in 2025

Table of Contents

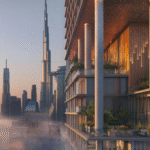

The World Islands, a 300-island man-made archipelago by Nakheel, spans 6x9km in the Persian Gulf, 4km off Dubai’s coast, shaped like a world map with 232km of shoreline. With AED 1.8 billion ($490 million) in transactions in 2024 and a 25% sales increase in Q1 2025, it offers 6-10% rental yields and 15-25% capital gains, per gulfbusiness.com and dxbinteract.com.

Accessible by private boat (10 minutes to Jumeirah, 15 to Dubai Marina, 30 to Dubai International Airport) or helicopter, it relies on independent utilities like diesel generators, per en.wikipedia.org. In 2025, ultra-luxury villas on exclusive islands redefine private island living, targeting high-net-worth individuals (HNWIs) with bespoke designs and resort-style amenities.

Below are six unique villas across The World Islands, detailing their features, investment potential, and compliance with the Dubai Land Department (DLD) and Federal Tax Authority (FTA), leveraging Dubai’s 18.7 million tourists in 2024, per dxboffplan.com.

1. Amali Island – Avatea Grande Villa

Overview: A 7-bedroom villa by Amali Properties on Amali Island, priced at AED 137 million ($37.3 million). Handover in Q1 2027, per amali-island-dubai.com.

Features: A 32,791 sq.ft. three-story villa in Grande style with a private beach (50m frontage), yacht berth for a Riva Rivarama 44, and 360° views of Burj Khalifa and Palm Jumeirah. Includes a basement with a cinema, sauna, spa, gym, and water sports garage. Outdoor amenities feature a lazy river, saltwater pool, and shisha lounge. Near a private clubhouse (5-minute walk), per amaliproperties.com.

Investment Potential: Yields of 6-8% (e.g., AED 8.22 million/year) and 15-20% capital gains by 2028, driven by exclusivity (24 villas total) and rental demand, per dxbinteract.com. Payment plan: 60/40 (60% during construction, 40% on handover).

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per taxvisor.ae.

2. Zuha Island – Beachfront Palace

Overview: A 6-bedroom villa by ZAYA and FIVE Holdings on Zuha Island, priced at AED 77.6 million ($21.1 million). Handover in Q2 2025, per opr.ae.

Features: A 33,105 sq.ft. four-story villa with a spiral staircase, private infinity pool, and 2.5km of beachfront access. Includes a panoramic elevator, multiple terraces, and a family lounge. Amenities feature a beach club, Mediterranean-inspired dining, and a floating paddle tennis court. Near a spa and gym (5-minute walk), per bayut.com.

Investment Potential: Yields of 7-9% (e.g., AED 6.98 million/year) and 15-18% capital gains by 2026, fueled by limited supply (30 villas) and tourist appeal, per aysdevelopers.ae. Payment plan: 50/50.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

3. Sweden Island – Swedish Palace

Overview: A 7-bedroom villa by Kleindienst Group in the Heart of Europe, priced at AED 80 million ($21.8 million). Handover in Q2 2025, per dubai-property.investments.

Features: A 24,532 sq.ft. five-story palace with Swedish-inspired design, private beach, and garden. Includes a rooftop pool, spa, and access to climate-controlled streets and an ice cave. Near Monaco Hotel (5-minute boat ride), per thoe.com.

Investment Potential: Yields of 6-8% (e.g., AED 6.4 million/year) and 15-20% capital gains by 2026, driven by European-themed exclusivity, per dxbproperties.ae. Payment plan: 50/50.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

4. Germany Island – Bauhaus Villa

Overview: A 5-bedroom villa by THOE on Germany Island, priced at AED 40 million ($10.9 million). Handover in Q4 2024, per offplanpropertiesdubai.ae.

Features: A 21,237 sq.ft. two-story villa with Bauhaus-inspired design, private pool, and exotic gardens. Offers access to a private marina, beach club, and spa. Near fine dining (5-minute walk), per offplanpropertiesdubai.ae.

Investment Potential: Yields of 6-7.5% (e.g., AED 3 million/year) and 10-12% capital gains by 2025, driven by early completion and tax-free living, per kaizenams.com. Payment plan: 60/40.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per taxvisor.ae.

5. Floating Seahorse Villa – Heart of Europe

Overview: A 3-bedroom floating villa by Kleindienst Group in the Heart of Europe, priced at AED 12 million ($3.27 million). Handover in Q1 2025, per thoe.com.

Features: A 4,004 sq.ft. three-level villa with an underwater bedroom, coral garden views, and acrylic pool bottom. Upper decks include a private pool and jacuzzi. Near Côte d’Azur hotels (5-minute boat ride), per dubai-property.investments.

Investment Potential: Yields of 7-9% (e.g., AED 1.08 million/year) and 15-20% capital gains by 2026, driven by unique underwater design, per dxbinteract.com. Payment plan: 50/50.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

6. Lebanon Island – Royal Island Villa

Overview: A 5-bedroom villa by Nakheel on Lebanon Island, priced at AED 49.5 million ($13.5 million). Handover in Q4 2024, per bayut.com.

Features: A 16,012 sq.ft. villa with private beach access, infinity pool, and watersports facilities. Includes access to the Royal Island Beach Club with dining and pools. Near Anantara Resort (5-minute walk), per anantara.com.

Investment Potential: Yields of 6-8% (e.g., AED 3.96 million/year) and 10-12% capital gains by 2025, driven by operational amenities and tourist demand, per aysdevelopers.ae. Payment plan: 60/40.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

Why These Villas Matter

These villas—Amali Island’s Avatea Grande, Zuha Island’s Beachfront Palace, Sweden Island’s Swedish Palace, Germany Island’s Bauhaus Villa, Floating Seahorse Villa, and Lebanon Island’s Royal Island Villa—offer unparalleled privacy and luxury, with 6-9% yields and 10-20% capital gains, outperforming Dubai’s 5-7% average, per dxbinteract.com.

Spanning 4,004-33,105 sq.ft., they feature private beaches, yacht berths, and unique designs (e.g., underwater bedrooms, Bauhaus architecture), appealing to HNWIs seeking exclusive retreats, per axcapital.ae. The islands’ 232km shoreline and proximity to Dubai’s skyline (4km offshore) ensure seclusion yet accessibility via boat or helicopter, per privateislandsonline.com.

Challenges include utility reliance on generators and erosion risks, mitigated by Nakheel’s AED 13 billion revival and 80% project completion, per riotimesonline.com. Posts on X highlight UHNWI interest, per @luxury_playbook. Golden Visa eligibility (AED 2 million+) applies to all villas, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 10-20% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

The World Islands’ 25% transaction growth in Q1 2025 and 6-9% ROI reflect strong demand, with 63% of 2024 sales off-plan, per prelaunch.ae. Flexible payment plans (e.g., 50/50, 60/40) and unique features like underwater bedrooms drive interest, per emirates.estate.

Risks include oversupply (41,000 new units by 2026) and delayed utilities, offset by scarce ultra-luxury inventory and Dubai’s 9,800 millionaire influx, per gulfnews.com. These villas, backed by Nakheel, Amali, and Kleindienst, redefine private island living, per signaturehabitat.com.

Conclusion

Amali Island’s Avatea Grande, Zuha Island’s Beachfront Palace, Sweden Island’s Swedish Palace, Germany Island’s Bauhaus Villa, Floating Seahorse Villa, and Lebanon Island’s Royal Island Villa are The World Islands’ top offerings for private island living in 2025, delivering 6-9% yields and 10-20% capital gains.

With bespoke designs, private beaches, and resort-style amenities, they cater to HNWIs seeking exclusivity. Compliance with DLD’s Ejari and FTA ensures secure investments in this iconic archipelago. The World Islands

read more: Palm Jebel Ali: 7 Residential Sectors Opening for Off-Plan Sales Soon in 2025