Now Reading: Trump’s 5% Remittance Tax May Push NRIs to Buy Homes

-

01

Trump’s 5% Remittance Tax May Push NRIs to Buy Homes

Trump’s 5% Remittance Tax May Push NRIs to Buy Homes

Table of Contents

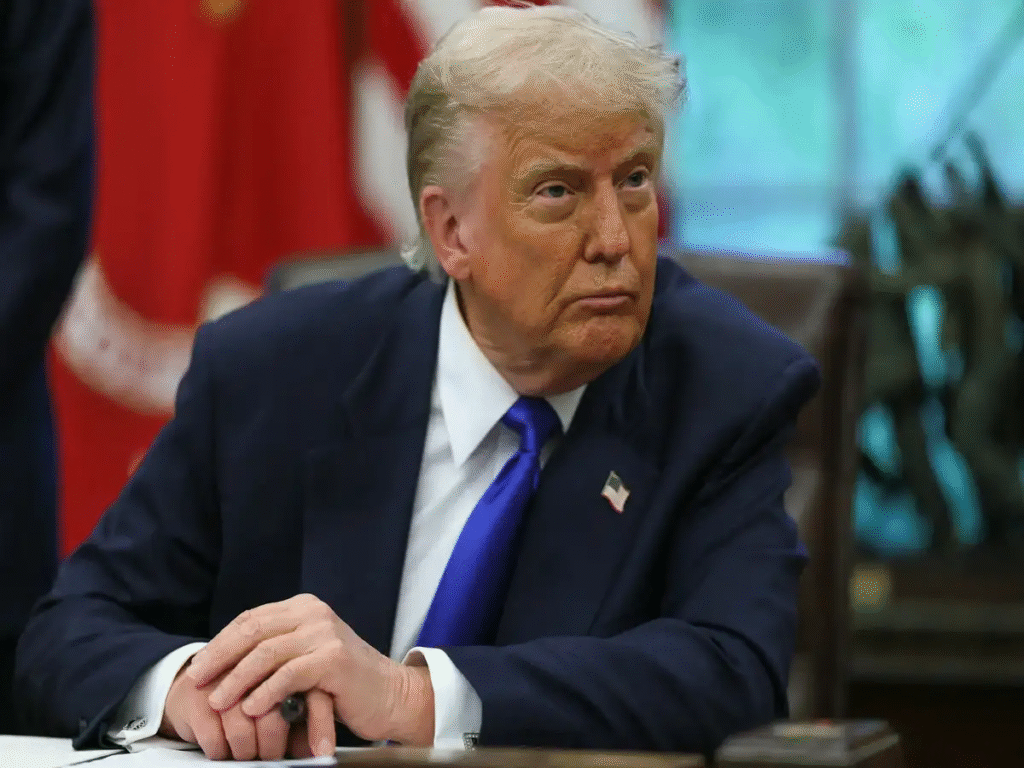

A new storm may be brewing for Non-Resident Indians (NRIs), especially those sending money to India. Former US President Donald Trump, who is currently campaigning for a second term in office, has reignited his controversial proposal — a 5% tax on all foreign remittances. The plan has sparked concern among Indian-origin families and investors in the US and other countries.

While the policy is not yet official, the possibility of such a tax has opened up a bigger question: Should NRIs fast-track their real estate investments in India before any such tax is implemented?

Let’s break it down.

What Is the Proposed 5% Remittance Tax?

Donald Trump has been vocal about restricting the outflow of money from the US to foreign countries. As part of his broader America First strategy, he wants to impose a 5% tax on money sent overseas, including personal remittances — which means NRIs sending money to India to support their families or invest back home could be taxed.

Though the details of the proposal are still unclear, experts believe it could:

- Be applied to all remittances above a certain limit

- Affect both personal and investment-related transfers

- Come with penalties or tracking systems via banks or money transfer agencies

This move, if implemented, could reduce the value of funds received in India by a significant margin.

Why Are NRIs Worried?

India receives over $120 billion in remittances annually, making it the top recipient in the world. A major share comes from Indian communities living in the US, UAE, Canada, and the UK.

If a 5% tax becomes reality, NRIs may face:

- Higher cost of sending money to India

- Reduced savings for long-term goals

- Impact on family support and investment plans

- Lower returns on overseas real estate purchases

This is especially crucial for those planning to buy property in India, start a business, or support elderly parents financially.

Is This a Good Time to Invest in Indian Real Estate?

Real estate in India has been showing steady growth post-COVID. Cities like Hyderabad, Bengaluru, Pune, and Delhi-NCR have become top choices for NRIs due to:

- Rapid infrastructure development

- Rising rental income opportunities

- Growing demand for premium and mid-range homes

- Weak Indian rupee making property more affordable in dollar terms

With the threat of a 5% remittance tax, NRIs are now rethinking their timelines. Many financial experts suggest that if you are planning to invest in India in the next year or two, it may be smart to fast-track your decision now.

How the Tax Could Affect Real Estate Plans

Let’s say you plan to send $100,000 (approx. ₹83 lakh) to purchase a property in India.

- Under current rules: You send $100,000, and your family or real estate developer in India receives the full amount.

- Under Trump’s proposed tax: You may have to pay $5,000 in tax — reducing the amount available for investment or increasing your total cost.

This could delay investment decisions, affect down payments, or even force buyers to settle for lower-value properties.

For many NRIs who have been saving to build a home in India, this proposed tax might eat into years of savings.

Fast-Tracking Property Purchases: What You Should Know

If you are considering real estate investment in India before any new US policies take effect, here are a few steps to take:

1. Identify Ready-to-Move Projects

Avoid the risk of construction delays. Look for completed or near-complete properties in metro areas with high demand.

2. Use Legal and Verified Channels

Work with trusted real estate agents and legal consultants. Make sure property titles are clean, and all taxes and dues are paid.

3. Leverage Weak Rupee

A weaker rupee means your dollars go further. Lock in favorable exchange rates now to get better deals.

4. Consult a Financial Advisor

Discuss how Trump’s policy could affect your future investments. Tax planning and fund transfers need to be optimized now more than ever.

What Are NRIs Saying?

Many NRIs are already taking proactive steps.

“I was planning to buy a flat in Hyderabad by the end of 2025,” says Rajesh Kumar, a tech worker based in California. “But after hearing about the tax, I’ve started looking at projects to finalize by this December.”

Real estate developers in India are also rolling out special NRI offers and early booking discounts, sensing the urgency.

What If the Tax Doesn’t Pass?

Some might argue: what if Trump doesn’t win the election, or the tax never gets implemented?

That’s a valid point. However, in real estate, timing matters. Property prices in India have been rising, and delaying investment could still mean higher costs later — even without the tax.

Moreover, many other countries may follow suit with remittance regulations as global economies tighten money flow across borders.

So acting early can help you avoid possible future restrictions and lock in investments while rates are still attractive.

Final Thoughts: Should You Act Now?

If you are an NRI with plans to:

- Buy property in India

- Send money regularly for family or investments

- Save tax and avoid future policy shocks

…then this might be the best time to make your move.

While the Trump 5% remittance tax is not yet law, the threat is real, and global financial trends are shifting. Real estate is not just about property — it’s about security, returns, and future planning.

With the Indian property market on an upward path and possible remittance hurdles ahead, fast-tracking your real estate investment might just be the smartest decision of 2025.

Also read –Maharashtra Real Estate to Boom Like Never Before!