Now Reading: UAE Silver Boom: What Every Investor Must Know Now 2025

-

01

UAE Silver Boom: What Every Investor Must Know Now 2025

UAE Silver Boom: What Every Investor Must Know Now 2025

Table of Contents

In recent years, silver in the UAE has become more than just a precious metal used in jewelry. Today, it is a growing force in investments, industrial use, and fashion. Once overshadowed by gold, silver is now experiencing a sharp rise in demand across multiple sectors in the Emirates.

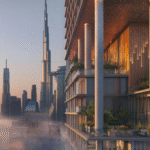

With a global shift towards renewable energy and electronics, silver’s value is being recognized beyond traditional uses. The UAE, known for its luxury markets and strong trading economy, is playing a major role in shaping silver’s future.

A Resilient Metal with Expanding Value

Silver has always held cultural and economic importance in the Middle East. From ancient Islamic coins to modern silverware and ornaments, the metal has remained in demand. But in 2025, silver’s role is growing rapidly due to two powerful trends industrial demand and investment appeal.

In industries, silver is essential for electronics, solar panels, electric vehicles (EVs), and medical tools. Its conductivity, antibacterial properties, and affordability compared to gold make it a top choice for modern technologies. As the UAE accelerates its green goals and tech manufacturing, silver is becoming a key element in that mission.

At the same time, individual investors are buying more silver coins, bars, and jewelry. Many view silver as a “safe haven” a stable investment option in uncertain global economic conditions. With gold prices at record highs, silver presents a more accessible and attractive alternative.

Dubai and Sharjah Leading the Silver Trade

Dubai has always been the heart of the UAE’s jewelry and bullion markets. The famous Gold Souk in Deira now sees a significant share of silver buyers tourists and locals alike. Retailers confirm that silver jewelry and coins are seeing a sharp increase in sales.

Meanwhile, Sharjah has positioned itself as a key player in silver manufacturing and wholesale. With new silver refining units and craft workshops opening in industrial zones, the emirate is building a strong supply chain for silver-related products.

The UAE’s zero-tax environment and strong logistics network also make it an attractive hub for international silver trade. Importers and exporters benefit from high-quality infrastructure, fast shipping, and global access.

Fashion Meets Finance: Silver Jewelry Booms Again

The UAE fashion market is also playing a part in silver’s revival. Influencers, celebrities, and fashion brands have turned to silver-based jewelry for its modern look, affordability, and versatility.

Unlike gold, silver pairs well with both western and traditional wear. From minimalist rings and chains to ornate bridal sets, silver has made a comeback especially among millennials and Gen Z consumers.

According to several leading jewelers, silver now accounts for up to 30% of their total jewelry sales in 2025, compared to just 15% a few years ago. Social media and e-commerce platforms have helped smaller brands and designers promote handcrafted silver pieces with unique designs, boosting its market even more.

Investment in Silver Gaining Ground

Alongside fashion, silver investment is growing steadily in the UAE. Bullion dealers report a 40% increase in silver bar and coin sales since 2023. This trend is driven by:

- Rising inflation globally

- Currency fluctuations

- Economic uncertainties

- Limited availability of physical silver

Silver Exchange-Traded Funds (ETFs) and digital silver platforms are also gaining attention. UAE-based fintech startups now allow users to buy and trade silver digitally, just like stocks or crypto. This makes silver more accessible to younger investors looking for safer assets.

Experts believe that with silver prices projected to rise due to increasing industrial demand, now is a good time for strategic long-term investments in the metal.

Silver and Sustainability: The Green Factor

Another reason silver is gaining value in the UAE is its connection to green energy. Silver is a crucial material used in photovoltaic cells for solar energy. As the UAE pushes toward sustainability and clean energy under its “Net Zero 2050” plan, the need for silver will grow significantly.

With large solar projects like the Mohammed bin Rashid Al Maktoum Solar Park and industrial partnerships in clean tech, the silver supply chain is expected to become even more important for the country’s future.

This positions the UAE as a regional hub not just for luxury silver, but for silver-powered innovation and technology.

Challenges Ahead: Supply Risks and Market Volatility

Despite the growing demand, the silver market faces a few challenges. Silver mining is limited, and most global production happens outside the region. Any disruptions in supply chains like political unrest or environmental issues can lead to price spikes.

Moreover, silver is often a by-product of mining for other metals like copper and zinc. This makes supply unpredictable. In times of global crisis, silver prices can become volatile, which adds risk for investors.

However, experts suggest that for long-term investors and businesses, silver still holds strong value and potential in a diversified portfolio.

The Future of Silver in the UAE

The silver industry in the UAE is going through a transformation. No longer seen as gold’s less glamorous cousin, silver is now central to technology, clean energy, fashion, and finance.

With strong market support, rising industrial use, and consumer appeal, the UAE is likely to be one of the key regional leaders in the silver economy over the next decade. Business owners, designers, and investors are already finding new opportunities in this glowing market.

As global demand rises, silver in the UAE could become both a symbol of tradition and a tool of tomorrow’s innovation.

Read More:- Deyaar’s Latest Announcement Shakes Up the UAE Property Market