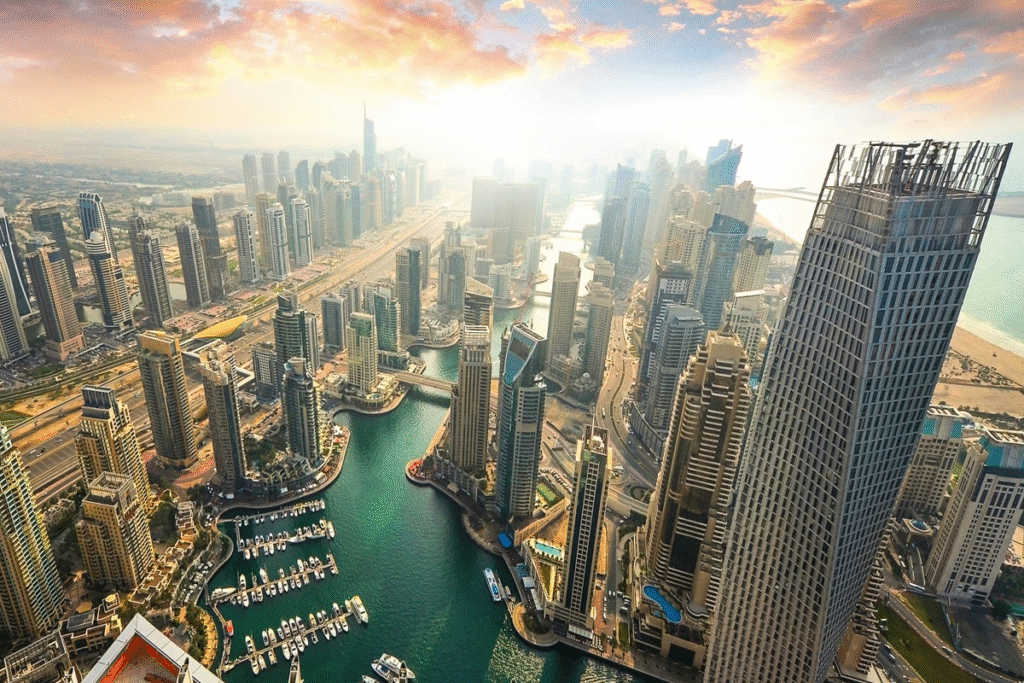

The intersection of technology and real estate in the UAE has become a focal point of discussion among investors, industry experts, and policymakers alike. As the UAE continues to position itself as a global hub for innovation and growth, the dynamics within its real estate sector are increasingly influenced by technological advancements. This article explores the ongoing debate between market correction and sustained growth in the UAE’s real estate landscape, emphasizing the crucial role technology plays in shaping these trends.

The UAE real estate market has experienced significant fluctuations over the past decade. From the explosive growth that characterized the early 2000s to the subsequent correction phases, the market has seen its fair share of highs and lows.

Recent years have demonstrated a gradual recovery, spurred by various factors such as population growth, economic diversification, and increased foreign investment.

However, the question remains: Is the current growth trajectory sustainable, or are we facing another potential market correction?

The advent of technology in the real estate sector has brought about transformative changes. Proptech, or property technology, has emerged as a key player in redefining how real estate transactions are conducted. This includes everything from virtual property tours to blockchain-based property transactions.

In the UAE, these innovations are not just enhancing the buying and selling experience but also optimizing property management and increasing transparency in transactions.

As a result, tech integration is helping to stabilize the market and potentially avert drastic corrections.

Data analytics has become an invaluable tool for stakeholders in the UAE real estate market. By analyzing trends, consumer behavior, and economic indicators, investors and developers can make informed decisions that mitigate risks associated with market fluctuations.

With sophisticated algorithms and predictive modeling, companies can forecast market trends more accurately, allowing them to capitalize on opportunities before they become apparent to the broader market.

This data-driven approach offers a safety net against potential downturns, contributing to the debate on whether the current growth can be sustained.

The UAE’s ambitious plans for developing smart cities are another critical factor influencing the real estate market. Initiatives like the UAE Vision 2021 aim to create sustainable urban environments that leverage technology to enhance the quality of life.

As smart technologies become integrated into urban planning, they create a more attractive environment for residents and investors alike. This can lead to increased demand for real estate, supporting the argument for sustained growth rather than a market correction.

Investors are increasingly looking for properties that align with these smart city initiatives, further solidifying the connection between technology and real estate.

One of the historical challenges in the UAE real estate market has been the imbalance between supply and demand. Overbuilding during periods of exuberance often leads to market corrections when demand fails to keep pace.

However, technology is enabling developers to better understand market needs and adjust their projects accordingly. By leveraging real-time data and market analytics, developers can create properties that cater to current demand, minimizing the risk of oversupply and subsequent corrections.

As this balance is achieved, the outlook for sustained growth becomes more favorable.

Fintech is revolutionizing how real estate transactions are financed in the UAE. With the rise of crowdfunding platforms and digital mortgage solutions, buyers have more options than ever.

This democratization of finance allows for greater participation in the real estate market, promoting stability and growth.

As more investors enter the market, the potential for significant corrections diminishes, leading to a more resilient real estate ecosystem.

The regulatory environment in the UAE is continually evolving, impacting the real estate sector. However, technology plays a pivotal role in helping stakeholders navigate these changes efficiently.

With the introduction of digital platforms for compliance and reporting, real estate professionals can adapt more swiftly to new regulations.

This agility not only fosters a more stable market but also enhances investor confidence, further supporting the case for sustained growth rather than impending correction.

As we explore the intersection of UAE tech and real estate, it’s evident that technology is not merely a tool but a catalyst for change. The debate between market correction and sustained growth is complex, yet the evidence suggests that the integration of technology offers a pathway to stability.

By leveraging data analytics, fostering smart city initiatives, and embracing innovative financing solutions, the UAE real estate market is better equipped to navigate potential challenges.

As stakeholders continue to adapt and evolve, the future appears bright, with the potential for sustained growth far outweighing the possibility of a market correction.

Do Follow Estate Magazine on Instagram

Read More:- Tech Districts Drive Booming Property Demand: 7 Powerful Impacts