Now Reading: What’s Next for Dubai’s Luxury Property Market? Boom or Bubble in 2025?

-

01

What’s Next for Dubai’s Luxury Property Market? Boom or Bubble in 2025?

What’s Next for Dubai’s Luxury Property Market? Boom or Bubble in 2025?

Table of Contents

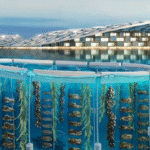

Dubai’s luxury property market has long attracted global attention. Known for its towering skyscrapers, world-class amenities, and ultra-modern lifestyle, Dubai remains a hotspot for high-net-worth individuals and investors. As 2025 unfolds, many are asking: Is Dubai’s luxury real estate market experiencing a genuine boom, or is it a bubble that could burst soon? This article explores the current trends, factors influencing the market, and expert opinions to help readers understand what lies ahead.

Dubai’s Luxury Market: A Quick Overview

Dubai has always positioned itself as a luxury destination, not only for tourism but also for real estate investment. From iconic buildings like the Burj Khalifa to luxury waterfront villas on Palm Jumeirah, the city offers properties that attract buyers worldwide.

In recent years, Dubai’s luxury property market has seen a remarkable revival after the global pandemic slowdown. Prices in many prime locations have surged, and demand for upscale apartments and villas is strong. With Expo 2020 Dubai boosting international interest and a growing population, luxury real estate is often seen as a safe and rewarding investment.

Factors Driving the Luxury Property Boom

Several key factors contribute to the current boom in Dubai’s luxury property market:

- Global Investors Seeking Safe Havens

Political and economic uncertainty in other parts of the world has made Dubai an attractive option for investors looking for stability and growth. Its strong legal framework, tax benefits, and strategic location make it a preferred choice. - High Demand from Wealthy Buyers

The increasing number of high-net-worth individuals moving to Dubai or purchasing properties there has raised demand for luxury homes. Many buyers are from Europe, Asia, and the Middle East, seeking a second home or permanent residence. - Government Initiatives and Reforms

Dubai’s government has introduced reforms like long-term visas and flexible property ownership rules for foreigners. These initiatives encourage more foreign investment and make the market more appealing. - Infrastructure and Lifestyle Improvements

Continuous improvements in infrastructure, entertainment, shopping, and leisure facilities keep Dubai a desirable place to live. Luxury developments often include exclusive amenities such as private beaches, golf courses, and smart home technologies.

Signs of a Bubble: What to Watch For

While the market’s growth is impressive, some experts warn of signs that could indicate a bubble:

- Rapid Price Increases

In some areas, property prices have risen quickly in a short time. Such rapid growth can sometimes lead to overvaluation, making prices unsustainable. - High Supply in Some Segments

Dubai has many new luxury projects underway. If supply outpaces demand, it could lead to oversupply, pushing prices down. - Speculative Buying

Investors purchasing properties primarily to sell quickly for profit, rather than for long-term use, may create volatility and risk. - Economic Factors

Changes in global economic conditions, oil prices, or geopolitical tensions could affect buyer confidence and purchasing power.

Expert Opinions: Boom or Bubble?

Real estate analysts and market experts provide mixed views:

- Positive Outlook

Many believe Dubai’s luxury property market is on solid ground, driven by genuine demand and strong fundamentals. They argue that the city’s unique position and ongoing developments will sustain growth without a major crash. - Cautious Approach

Some experts urge caution, noting that while growth is healthy, buyers should be wary of overpriced properties and overleveraging. They recommend thorough market research and a long-term investment perspective. - Potential for Correction

A few analysts warn that a market correction might occur if external shocks or excessive supply arise. However, they do not predict a full-scale crash, rather a possible stabilization of prices.

What Buyers and Investors Should Consider in 2025

For those interested in Dubai’s luxury property market, here are key tips:

- Research Locations Carefully

Prime areas like Downtown Dubai, Dubai Marina, and Palm Jumeirah remain popular. However, emerging neighborhoods may offer better value. - Understand Market Trends

Stay informed about price movements, supply levels, and government policies. Market timing can influence investment returns. - Verify Developer Reputation

Choose projects from trusted developers with proven track records to reduce risk. - Consider Long-Term Goals

Luxury properties often perform better as long-term investments. Decide whether the property is for personal use, rental income, or resale. - Seek Professional Advice

Consulting real estate agents, financial advisors, or legal experts can help make informed decisions.

Conclusion: Boom or Bubble in 2025?

Dubai’s luxury property market in 2025 shows strong signs of growth, backed by high demand, government support, and ongoing development. However, the rapid price increases and large upcoming supply call for careful analysis.

Whether the market is a boom or a bubble depends on various factors, including global economic stability and local market dynamics. For buyers and investors, the key lies in understanding these forces and making smart, informed choices.

Dubai remains a top destination for luxury real estate, but as with any investment, caution and due diligence are essential. The luxury property market’s future will likely balance between exciting growth opportunities and the need to avoid overheating.

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025