Luxury Housing is on track to perform better than the rest of the real estate sector in the upcoming year. As the mass-market housing segment continues to battle affordability concerns, oversupply issues, and fluctuating demand, luxury properties have carved out a more resilient and dynamic niche. This divergence in performance is being driven by several key factors including global wealth migration, stronger demand from ultra-high-net-worth individuals (UHNIs), limited high-end supply, favorable regulations, and the prestige associated with premium addresses.

Even as regulatory authorities like Telangana RERA tighten compliance norms—recently penalizing unregistered agents with a ₹3.69 lakh fine—the luxury segment remains relatively shielded. This is largely because affluent buyers typically engage with reputable developers, registered brokers, and legal advisors, which reduces exposure to malpractices common in lower-income property transactions.

Let’s explore why luxury housing is on the path to outperform in the current and upcoming market cycle.

High-net-worth individuals (HNWIs) around the world are relocating more than ever before. Cities like Dubai, Singapore, London, and Mumbai are seeing a large inflow of global capital into their luxury property markets. According to global wealth tracking firms, more than 1 lakh millionaires are expected to move across borders in 2025, and luxury housing in top-tier cities is their primary investment choice.

These buyers are not just looking for a house—they are seeking long-term value, lifestyle, security, and passport-based benefits. As a result, luxury housing is in high demand and poised for price appreciation in premium micro-markets.

India alone is expected to add more than 1,400 UHNIs by the end of 2025. With rising disposable incomes, new-age entrepreneurs, startup founders, and executives are investing in properties that offer both grandeur and exclusivity.

In metros like Delhi NCR, Bengaluru, Mumbai, and Hyderabad, there’s an increasing trend of HNWIs opting for sky villas, penthouses, and high-floor apartments with private amenities. What’s more, many are also expanding into second homes in vacation destinations like Goa, Lonavala, and Nainital, strengthening the luxury real estate ecosystem.

The supply of new luxury housing units has remained constrained compared to the mass-market housing sector. Developers have been cautious in launching ultra-luxury projects due to high input costs, longer construction timelines, and regulatory hurdles. This has resulted in a clear mismatch between demand and supply.

The scarcity of new, high-quality, RERA-compliant projects in prime areas is creating urgency among potential buyers. With fewer new launches and most inventory nearing full absorption, prices are expected to rise steadily.

While the Telangana RERA’s recent action against unregistered real estate agents reflects stricter scrutiny in the real estate sector, the luxury housing segment is largely unaffected. This is because luxury developers usually follow compliance norms and deal only with registered professionals.

The recent ₹3.69 lakh fine on a rogue agent in Telangana is a reminder of how regulators are cracking down on malpractice. Buyers in the luxury space benefit from higher transparency and legal security. This instills greater confidence in first-time investors and NRI buyers, who form a substantial chunk of luxury real estate clientele.

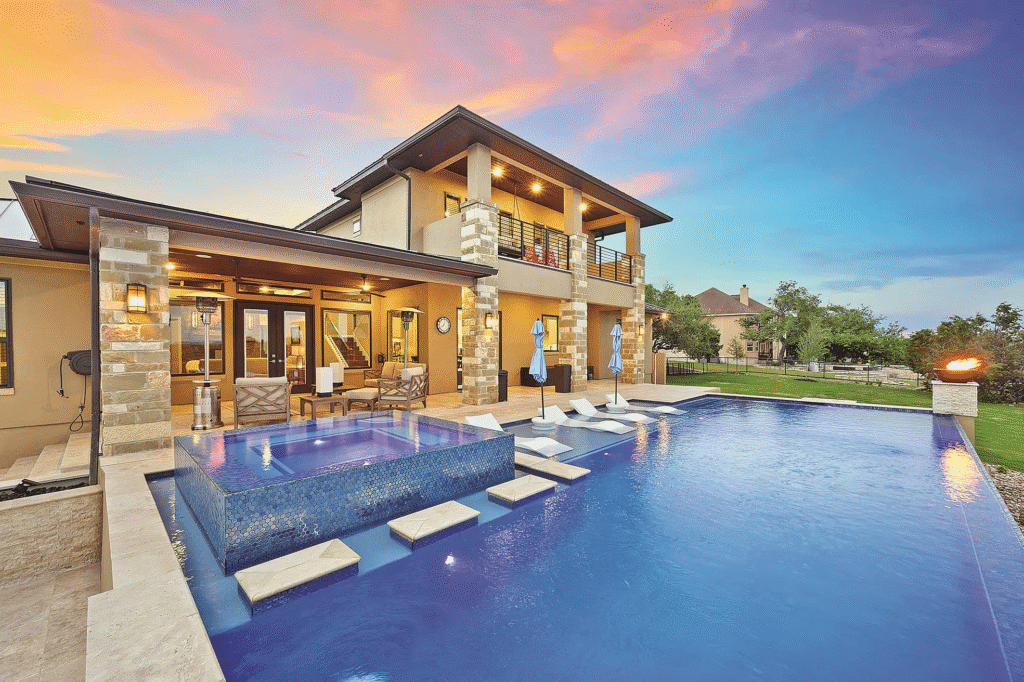

Post-pandemic, the definition of a dream home has evolved. Today’s buyers are no longer satisfied with just large rooms or branded tiles. They are actively looking for personalized amenities—such as home automation, rooftop gardens, private gyms, and wellness zones.

Luxury housing projects that offer curated experiences, sustainability, smart tech, and concierge services are commanding a premium. Developers that cater to these needs are reporting higher conversion rates, better retention, and word-of-mouth referrals.

In contrast, mid-income and affordable housing sectors are likely to continue facing challenges. Rising interest rates, inflationary pressure, job market volatility, and increased cost of raw materials are squeezing margins and reducing consumer appetite in these segments.

Additionally, government subsidies and affordable housing incentives are still not enough to offset the burden of high EMIs. While these challenges impact the mass housing segments, luxury housing stays largely untouched due to its audience’s high buying power and minimal loan dependency.

The recent ruling by Telangana RERA, where a real estate agent was fined ₹3.69 lakh for operating without proper registration, has sent a strong message across the industry. It underscores the importance of working with authorized professionals. This development, while targeted at compliance enforcement, also indirectly benefits the luxury housing market where most stakeholders are professionally licensed and regulated.

Buyers are now more inclined to verify agent credentials, and this growing awareness further secures the high-end real estate space from fraudulent practices.

With all indicators pointing toward growth, 2025 may mark a breakthrough year for luxury housing. As long as developers continue to align their offerings with the evolving lifestyle aspirations of their clientele, this segment will likely remain ahead of the curve.

Government policy is also becoming more favorable toward attracting foreign capital into real estate, especially in luxury development zones. Additionally, the digital transformation of real estate—from virtual tours to AI-powered personalization—has improved access and engagement for HNWIs looking to invest from afar.

Luxury Housing is clearly poised for better times than the rest of the real estate sector. Driven by high-net-worth demand, limited supply, regulatory safety, and elevated living preferences, this segment is expected to thrive in 2025 and beyond. As mainstream housing grapples with affordability and saturation, luxury properties remain a beacon of stability and aspirational investment.

For anyone looking to make a solid, future-proof real estate investment, luxury housing continues to stand out as a rewarding and reliable choice.

Also Read – Telangana Agent Gets ₹3.69 Lakh Fine for No License