Dubai has once again made headlines as one of the world’s most attractive real estate investment destinations. With high rental yields, no property taxes, and strong government support, investors from around the globe are flocking to the city to secure a piece of its growing property market. Whether you’re a first-time buyer or a seasoned investor, Dubai’s real estate landscape offers compelling opportunities in both residential and commercial sectors.

There are several reasons behind Dubai’s growing popularity among property investors:

One of the biggest advantages of investing in Dubai is the absence of property taxes. Once you buy a property, there are no annual property taxes or capital gains taxes, making it easier for investors to retain more profit.

Dubai offers some of the highest rental yields in the world. On average, investors can expect rental returns of 6% to 9%, compared to global cities like London or New York, where yields often fall below 4%.

Dubai is a global business and travel hub, located between Europe, Asia, and Africa. Its world-class infrastructure, including one of the busiest airports globally, makes it a magnet for international workers, tourists, and investors alike.

The UAE government has introduced several policies to attract foreign investors. These include:

The legacy of Expo 2020 continues to boost real estate growth. The event attracted millions of global visitors and led to the development of new communities like District 2020 (now Expo City Dubai), which has become a hub for innovation, sustainability, and smart living.

Investors are focusing on several key neighborhoods in Dubai:

Many developers are also launching off-plan properties in these areas, allowing buyers to pay in installments before the project is completed.

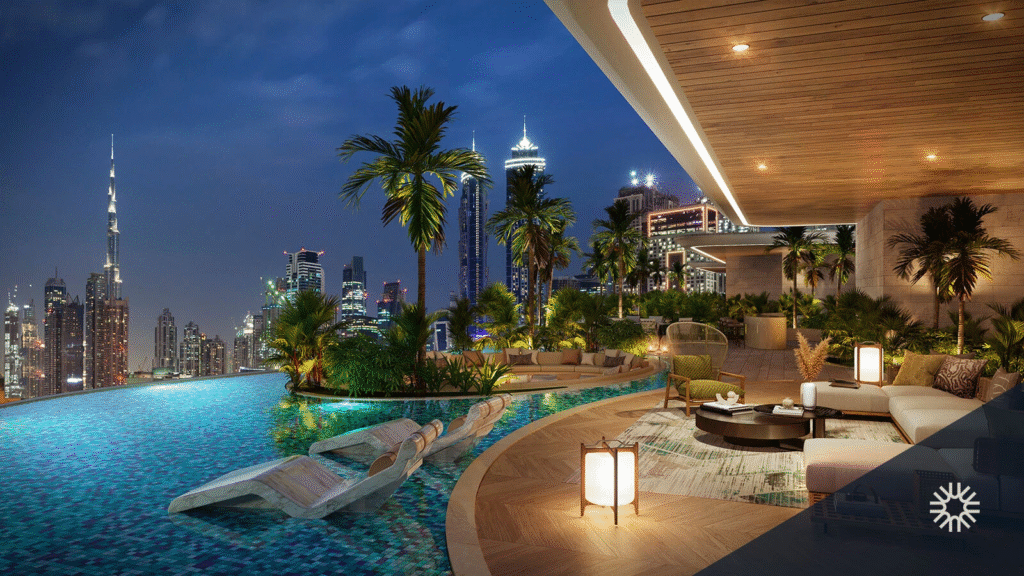

Foreign nationals, especially from India, China, Russia, the UK, and Europe, are leading the investment wave. Many are choosing Dubai as a second home, rental income source, or a retirement destination. Some are even relocating permanently, thanks to Dubai’s safe environment, excellent healthcare, and premium lifestyle offerings.

There is also rising interest from tech entrepreneurs and digital nomads, as Dubai now offers remote work visas and freelancer-friendly rules.

Like any investment, real estate in Dubai comes with risks. These include:

It’s crucial to work with a certified real estate agent and check that developers are approved by the Dubai Land Department (DLD) or Real Estate Regulatory Agency (RERA).

Rami Al Maktoum, a senior property advisor at Bayut, says,

“The demand for both luxury and affordable units has surged in the first half of 2025. Investors are focusing not just on rental returns, but long-term value appreciation.”

Aisha Kumar, a real estate analyst at Knight Frank, adds,

“Sustainability, smart technologies, and connectivity are shaping Dubai’s future. Areas like Expo City and Dubai South are gaining huge interest.”

Dubai’s real estate market is expected to grow steadily through 2025 and beyond, thanks to rising population, urban development, and investor confidence. Several mega projects are currently under construction, including The Heart of Europe, Dubai Islands, and Palm Jebel Ali, which promise to add more luxury and variety to the market.

The UAE’s commitment to long-term residency programs, digital innovation, and zero-tax policies continues to reinforce Dubai’s image as a global investment hub.

Dubai has firmly positioned itself as a real estate paradise. Whether you’re looking for steady rental income, long-term appreciation, or a safe investment in a thriving city, Dubai offers something for everyone. With government support, world-class infrastructure, and growing global interest, 2025 could be the perfect time to invest in Dubai real estate.

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025