Waterfront villas have always carried a sense of prestige and exclusivity. Yet, beyond the glamorous image of seaside living lies a strong financial case for investors. From high rental yields to impressive capital appreciation, these properties are proving to be one of the most rewarding real estate investments today.

This article explores why waterfront villas are not just lifestyle statements but also smart, future-proof investment assets.

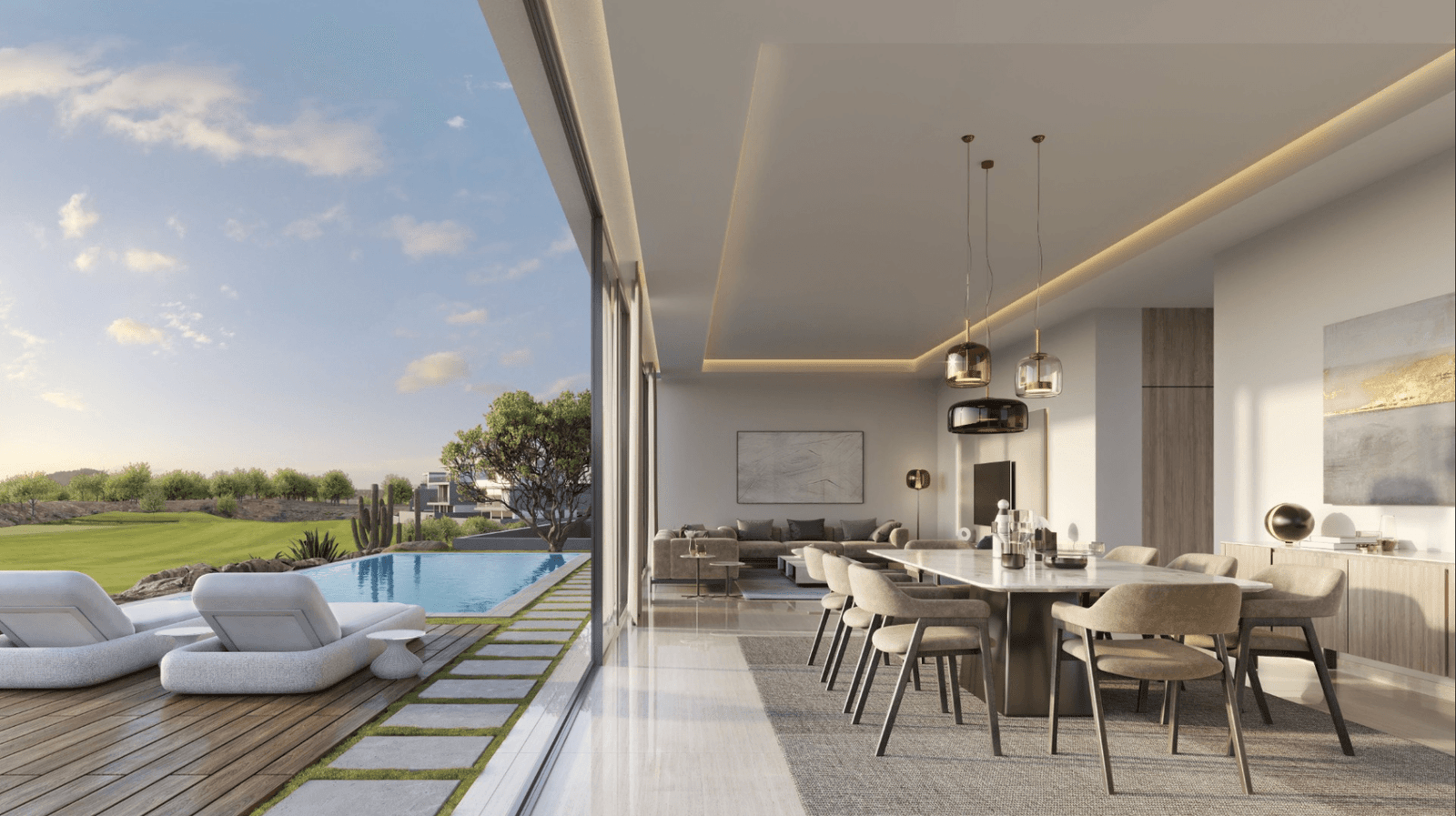

In today’s fast-paced urban world, people crave calm, open spaces and scenic surroundings. Waterfront homes—whether along a beach, lake, or marina—offer this rare combination of tranquility and modern comfort.

Buyers are increasingly drawn to the lifestyle benefits these properties offer:

With more high-net-worth individuals and global investors eyeing lifestyle-based investments, the demand for waterfront villas has skyrocketed in premium markets like Dubai, Miami, and the Maldives.

One of the most compelling reasons to invest in waterfront villas is their resilience during economic slowdowns. While general property prices might fluctuate, premium waterfront locations tend to hold or increase in value.

This stability comes from several factors:

When the broader real estate market cools, luxury waterfront homes often remain unaffected—or bounce back faster—thanks to their strong appeal and investor confidence.

Investors aren’t just buying villas for future appreciation—they’re also capitalizing on strong rental potential. In prime markets, luxury villas by the water attract high-income tenants willing to pay premium rents.

Short-term rentals in tourist-heavy destinations such as Dubai’s Palm Jumeirah, the French Riviera, or Bali can yield returns significantly higher than average apartments. For long-term tenants, the exclusivity and lifestyle offered by such properties make them willing to pay above-market rates.

Example rental advantages:

Thus, investors enjoy both consistent cash flow and strong capital growth—making waterfront villas a dual-benefit asset.

Beyond numbers and profits, waterfront villas hold immense emotional appeal. For many buyers, the investment is equally about lifestyle enhancement.

Imagine waking up to panoramic sea views, enjoying private beach access, or having the sound of gentle waves as your daily background. These experiences carry an intangible value—one that cannot be replicated by standard urban homes.

This emotional attachment also plays a role in value retention. Owners are less likely to sell quickly, and when they do, they command premium prices. The sense of pride and exclusivity keeps demand high and supply tight.

The new generation of waterfront villas is not just about beauty and luxury—it’s about innovation. Developers are now incorporating smart home technology and eco-friendly design to appeal to a sophisticated audience.

Modern villas often include:

These features make waterfront villas future-ready investments—balancing comfort, technology, and environmental responsibility.

Certain global destinations have emerged as prime investment zones for waterfront villas, offering strong returns, lifestyle appeal, and stable governance.

1. Dubai, UAE

The city’s iconic Palm Jumeirah and upcoming waterfront developments like Dubai Islands are magnets for global investors. With tax-free benefits and year-round sunshine, Dubai’s luxury waterfront real estate continues to outperform most markets.

2. The Maldives

Exclusive resort-style villas on private islands are in high demand among international investors seeking ultimate luxury and privacy.

3. Miami, USA

With its combination of business appeal, stunning coastlines, and cosmopolitan culture, Miami remains a global hub for waterfront property investments.

4. Bali, Indonesia

For investors seeking lifestyle-driven investments with great short-term rental potential, Bali’s beachfront villas offer impressive ROI and strong tourism demand.

5. The French Riviera

The timeless appeal of locations like Cannes and Saint-Tropez continues to attract ultra-high-net-worth individuals from across the world.

Real estate experts often emphasize one golden rule: “Buy location, not property.” Waterfront villas embody this principle perfectly.

Their location—combined with exclusivity, scenic value, and limited availability—drives steady price appreciation. Historical trends show that properties near water tend to appreciate faster than inland homes.

Moreover, such villas hold long-term generational value. Many investors see them as legacy assets—properties that can be passed down and continue appreciating over decades.

Key factors contributing to appreciation include:

While the rewards are immense, investors should also consider certain factors before purchasing a waterfront villa.

1. Maintenance Costs:

Waterfront homes require higher maintenance due to saltwater exposure and humidity. Using high-quality materials and regular upkeep is crucial.

2. Insurance:

Depending on the location, properties near the water may require specialized insurance for potential risks like flooding or erosion.

3. Legal Regulations:

Some countries have restrictions on foreign ownership of coastal properties. Always verify property rights, residency laws, and ownership structures.

4. Property Management:

For investors renting out villas, hiring a professional property management company ensures proper maintenance and rental income optimization.

By understanding these aspects, investors can minimize risks and maximize returns.

One major advantage of investing in waterfront villas is the flexibility of use. Owners can enjoy the property for personal vacations while renting it out when not in use.

This dual purpose ensures:

For investors who value both lifestyle and financial returns, this hybrid approach is highly attractive.

As global wealth shifts toward experience-driven living, waterfront properties are positioned to thrive. Developers are reimagining coastal living with advanced sustainability, integrated marinas, and resort-style communities.

Moreover, the rising trend of remote work has increased demand for homes that combine luxury and relaxation—making waterfront villas the perfect choice.

Digital nomads, entrepreneurs, and retirees are all eyeing such properties for both comfort and prestige. With limited land availability near coasts, the long-term outlook for these villas remains exceptionally strong.

Investing in waterfront villas isn’t just about luxury—it’s about strategic wealth building through an asset that merges emotional and financial value.

Waterfront villas represent more than just stunning architecture or scenic views. They embody a secure investment choice that combines high returns, prestige, and personal fulfillment.

As global demand for lifestyle real estate grows, these properties will continue to outperform traditional investments. Whether you’re an experienced investor or a first-time buyer, the waterfront villa market offers an unmatched balance between luxury and long-term financial security.

If there’s one investment that delivers both serenity and strength—it’s a waterfront villa.

Do Follow Estate Magazine on Instagram

Read More:- Dubai’s Innovative AI Strategies Changing Daily Life Rapidly 2025