Now Reading: Zero Income Tax: Why Dubai Real Estate Attracts Global Investors in 2025

-

01

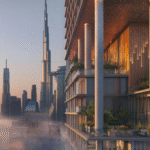

Zero Income Tax: Why Dubai Real Estate Attracts Global Investors in 2025

Zero Income Tax: Why Dubai Real Estate Attracts Global Investors in 2025

Table of Contents

Imagine earning every penny of your investment returns without a single dirham going to taxes. In Dubai, this isn’t a dream it’s reality. Zero Income Tax, With zero personal income tax, capital gains tax, or annual property taxes, Dubai’s real estate market is a magnet for global investors seeking financial freedom. The UAE’s dirham, pegged to the U.S. dollar, eliminates currency risk, while residential sales and rentals are VAT-exempt, saving thousands upfront.

Free zone properties offer zero corporate tax for up to 50 years, making Dubai a haven for wealth-building. In 2025, with a 5% population boom, 25 million expected tourists, and a 6.2% GDP growth, Dubai’s property market is projected to see 5-8% price appreciation and 6-10% rental yields, outpacing global hubs like London (2-4%) or New York (3-4%). From affordable studios to luxury villas, Dubai’s tax-free ecosystem, flexible payment plans, and Golden Visa perks draw investors from India, the UK, Germany, and beyond.

Let’s explore why Dubai’s real estate is the ultimate choice for global investors in 2025, with a focus on key neighborhoods, tax perks, and strategies to maximize returns.

The Tax-Free Advantage: Keeping Every Dirham

Zero Income Tax, Dubai’s zero-tax policy is a game-changer. In most countries, a $200,000 property yielding 7% ($14,000 annually) could lose $2,800-$4,200 to taxes. In Dubai, you keep the full $14,000. Selling a property for a $100,000 profit? In the U.S., you’d face up to 20% capital gains tax ($20,000). In Dubai, that profit is yours, tax-free. Residential sales and rentals are VAT-exempt, saving 5% ($5,000-$20,000) on purchases. Free zone properties, like those in Dubai Studio City or Business Bay, allow you to set up a company with zero corporate tax, potentially saving $1,000-$20,000 annually on rental income.

For U.S. investors, deductions like depreciation ($3,000-$30,000) and mortgage interest ($6,000-$20,000 for a $150,000-$500,000 loan at 4%) can slash your tax bill back home. Non-U.S. investors, like those from the UK, avoid capital gains tax (20-28%), and double taxation treaties with 130+ countries ensure you’re not taxed twice. This tax-free framework makes Dubai a global standout, letting you reinvest every dirham for exponential growth.

Jumeirah Village Circle: Affordable Entry to Tax-Free Wealth

Jumeirah Village Circle (JVC) is a favorite for investors seeking high returns on a budget. This vibrant community offers studios to 3-bedroom apartments priced from $136,125 to $545,000, with 7-10% rental yields. A $150,000 studio could generate $12,000-$15,000 annually, all tax-free, compared to $8,400-$10,500 elsewhere. Projects like Sereno Residences feature parks, schools, and proximity to Circle Mall, attracting young professionals and families.

The zero-VAT policy saves $6,806-$27,250 per purchase, and a free zone company eliminates corporate tax on up to $54,500 in rental income, saving $5,450 yearly. U.S. investors can deduct depreciation ($4,950-$19,818) and management fees ($762-$3,815), saving up to $7,346 at home. With flexible 60/40 payment plans requiring a 10% deposit ($13,613-$54,500), JVC is accessible for first-time investors. Its 7% price growth forecast and Al Khail Metro connectivity make it a hotspot for tax-free returns, perfect for those starting their investment journey.

Dubai Hills Estate: Luxury With Tax-Free Perks

For those craving luxury, Dubai Hills Estate delivers. This master-planned community offers 2-6 bedroom villas and apartments priced from $408,375 to $2.18 million, with 6-8% yields. A $500,000 apartment in Emaar Collective 2.0 could yield $35,000 annually, tax-free, versus $24,500-$28,000 in tax-heavy markets. With golf-course views, Dubai Hills Mall, and top-tier schools, it’s a magnet for high-net-worth expats and families.

Zero-VAT sales save $20,419-$108,900, and a free zone company eliminates corporate tax on up to $174,400 in rental income, saving $17,440 annually. U.S. investors can deduct depreciation ($14,836-$79,273) and management fees ($2,283-$13,952), saving up to $29,451. With 28.7% villa price growth and Golden Visa eligibility for properties over $545,000, Dubai Hills Estate blends prestige with tax-free wealth. Its serene environment ensures strong tenant demand, making it ideal for long-term investments.

Dubai Marina: Waterfront Returns Without Tax

Dubai Marina’s iconic skyline and waterfront lifestyle draw investors worldwide. Offering 1-3 bedroom apartments priced from $326,700 to $816,750, with 6-8% yields, projects like Marina Gate feature yacht views and retail hubs. A $400,000 apartment could generate $28,000 in rent, tax-free, compared to $19,600-$22,400 elsewhere.

The zero-VAT policy saves $16,335-$40,838 per purchase, and a free zone company eliminates corporate tax on up to $65,340 in rental income, saving $6,534 annually. U.S. investors can deduct depreciation ($11,873-$29,673) and management fees ($1,827-$5,227), saving up to $11,006. With 6.2% price growth and DMCC Metro access, Dubai Marina’s vibrant nightlife and beach proximity ensure high occupancy for short- and long-term rentals. Flexible 60/40 payment plans with a 10% deposit make it accessible for mid-to-high-income investors.

Business Bay: Corporate Hub With Tax-Free Edge

Business Bay, a dynamic commercial-residential hub, is perfect for investors targeting corporate tenants. Offering studios to 3-bedroom apartments priced from $272,250 to $1.09 million, with 6-8% yields, projects like Peninsula Four feature canal views and DIFC proximity. A $300,000 apartment could yield $21,000 annually, tax-free, versus $14,700-$16,800 elsewhere.

Zero-VAT sales save $13,613-$54,500, and a free zone company eliminates corporate tax on up to $87,200 in rental income, saving $8,720 annually. U.S. investors can deduct depreciation ($9,891-$39,636) and management fees ($1,523-$6,976), saving up to $14,678. With 17% office rent increases and Business Bay Metro connectivity, this hub guarantees high demand. A 70/30 payment plan with a 10% deposit ($27,225-$109,000) makes it appealing for investors seeking steady cash flow.

Dubai Studio City: Creative Hub for High Yields

Dubai Studio City (DSC), a free zone for media and creative industries, is a rising star for investors. Offering studios to 2-bedroom apartments priced from $136,125 to $408,375, with 7-10% yields, projects like Glitz by Danube and Skylofts by Emaar feature smart home tech and proximity to Dubai Sports City. A $150,000 studio could generate $12,000-$15,000 in rent, tax-free, versus $8,400-$10,500 elsewhere.

Zero-VAT sales save $6,806-$20,419, and a free zone company eliminates corporate tax on up to $36,754 in rental income, saving $3,675 annually. U.S. investors can deduct depreciation ($4,950-$14,836) and management fees ($762-$2,610), saving up to $5,503. With 5-8% price growth and Blue Metro Line connectivity, DSC’s appeal to creatives ensures strong rental demand. Flexible 1% monthly payment plans ease entry, making it ideal for short-term rental investors.

Al Nahda: Affordable Tax-Free Gem

Al Nahda, near the Dubai-Sharjah border, is a haven for mid-income investors. Offering studios to 2-bedroom apartments priced from $95,300 to $272,250, with 7-9% yields, projects like Al Nahda Tower and Platinum Residences feature modern amenities and proximity to Sahara Centre. A $120,000 studio could yield $10,800 annually, tax-free, compared to $7,560-$8,640 elsewhere.

Zero-VAT sales save $4,765-$13,613, and a free zone company eliminates corporate tax on up to $24,503 in rental income, saving $2,450 annually. U.S. investors can deduct depreciation ($3,465-$9,891) and management fees ($534-$1,742), saving up to $3,669. With 7-10% price growth and Al Nahda Metro access, this area attracts families and professionals. A 60/40 payment plan with a 10% deposit ($9,530-$27,225) makes it perfect for first-time buyers.

Maximizing Your Tax-Free Returns

Dubai’s tax-free structure is amplified by strategic moves. Setting up a free zone company ensures zero corporate tax on rental income, saving $1,000-$20,000 annually, depending on property value. Small business relief eliminates corporate tax for revenues under $816,000 until December 31, 2026, ideal for individual investors and SMEs. Zero-VAT sales save $4,765-$108,900 per transaction, and no capital gains tax preserves profits on appreciation.

For U.S. investors, reporting rental income on Schedule E allows deductions for depreciation, maintenance ($1,500-$5,000), management fees ($534-$13,952), and mortgage interest, cutting your U.S. tax bill. Non-U.S. investors benefit from no UK capital gains tax and double taxation treaties. Green incentives, requiring DEWA registration, save $1,000-$6,000 annually on utilities, boosting your net returns.

Navigating Risks for Success

Dubai’s real estate isn’t without risks—off-plan delays, oversupply (41,000 new units), and global economic shifts could impact returns. Mitigate these by choosing trusted developers like Emaar, Danube, or Select Group, and verifying escrow compliance under the 2025 Oqood system. Target high-demand areas like Dubai Marina or Business Bay for tenant stability. Ensure VAT exemption eligibility and proof of funds compliance to avoid fines up to $136,125. Golden Visa eligibility for properties over $545,000 adds residency perks, enhancing long-term value.

Why Dubai in 2025?

Dubai’s tax-free real estate market is a global outlier, offering unmatched financial freedom. JVC and Al Nahda provide affordable entry points, Dubai Hills Estate and Dubai Marina cater to luxury seekers, and Business Bay and Dubai Studio City target professionals and creatives. With 58% of buyers being foreign nationals, flexible payment plans, and yields up to 10%, Dubai aligns with its 2040 Urban Master Plan for sustainable growth.

Whether you’re a first-time investor eyeing a JVC studio or a high-net-worth individual targeting a Dubai Hills villa, Dubai’s zero-tax ecosystem lets your wealth grow unchecked. Consult a tax professional to optimize your strategy, and seize the opportunity to thrive in Dubai’s dynamic market in 2025.

read more: Top Dubai Neighborhoods With Tax-Free Investment Opportunities in 2025